December is usually filled with blogs and articles predicting the year ahead. Looking back at this time last year, it’s highly unlikely anyone got 2020 right. Thanks to the pandemic, this year has been a period of many “firsts” and hopefully just as many “lasts.”

For banks and insurance companies 2020 has been a chaotic period of change with a surge in remote banking, new loans through the Paycheck Protection Program (PPP) and an overall consumer preference to conduct insurance matters online. At the same time, both industries, along with the rest of the world, processed a mass employee migration from office to home.

Through it all, the cloud has reigned supreme.

Rarely has any infrastructure experienced so much stress in so little time. Some companies had made investments in the cloud to prepare for an increase in online consumer and employee activities. Others were not so fortunate.

So, as we look ahead to 2021, now’s the time to ask if your cloud is ready for what lies ahead.

To meet next year’s challenges, banks and insurance companies need a multi-cloud environment that is safe, secure and can scale without breaking budgets or falling out of compliance with industry regulations. Without clear visibility and management across the entire cloud, customers could be lost, opportunities might be missed, and audits could become nightmares.

In addition to speed and convenience, mobile banking and insurance is placing new demands on your cloud, including volume spikes, unauthorized access, multiple device authorizations and a pathway for hackers to access your infrastructure. You could find yourself quickly out of compliance with key regulations, under- or over-provisioned, and drifting from your approved configurations. These risks and vulnerabilities can cripple your IT infrastructure and diminish your reputation and customer relationships.

Start the year with a healthy cloud

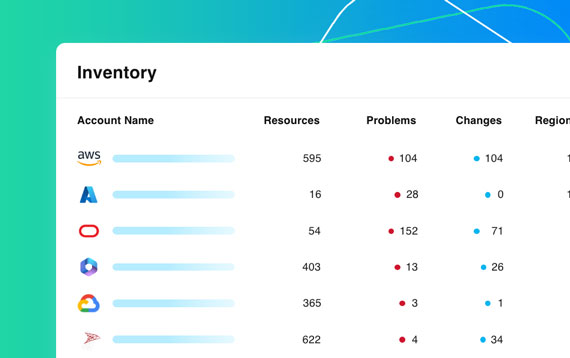

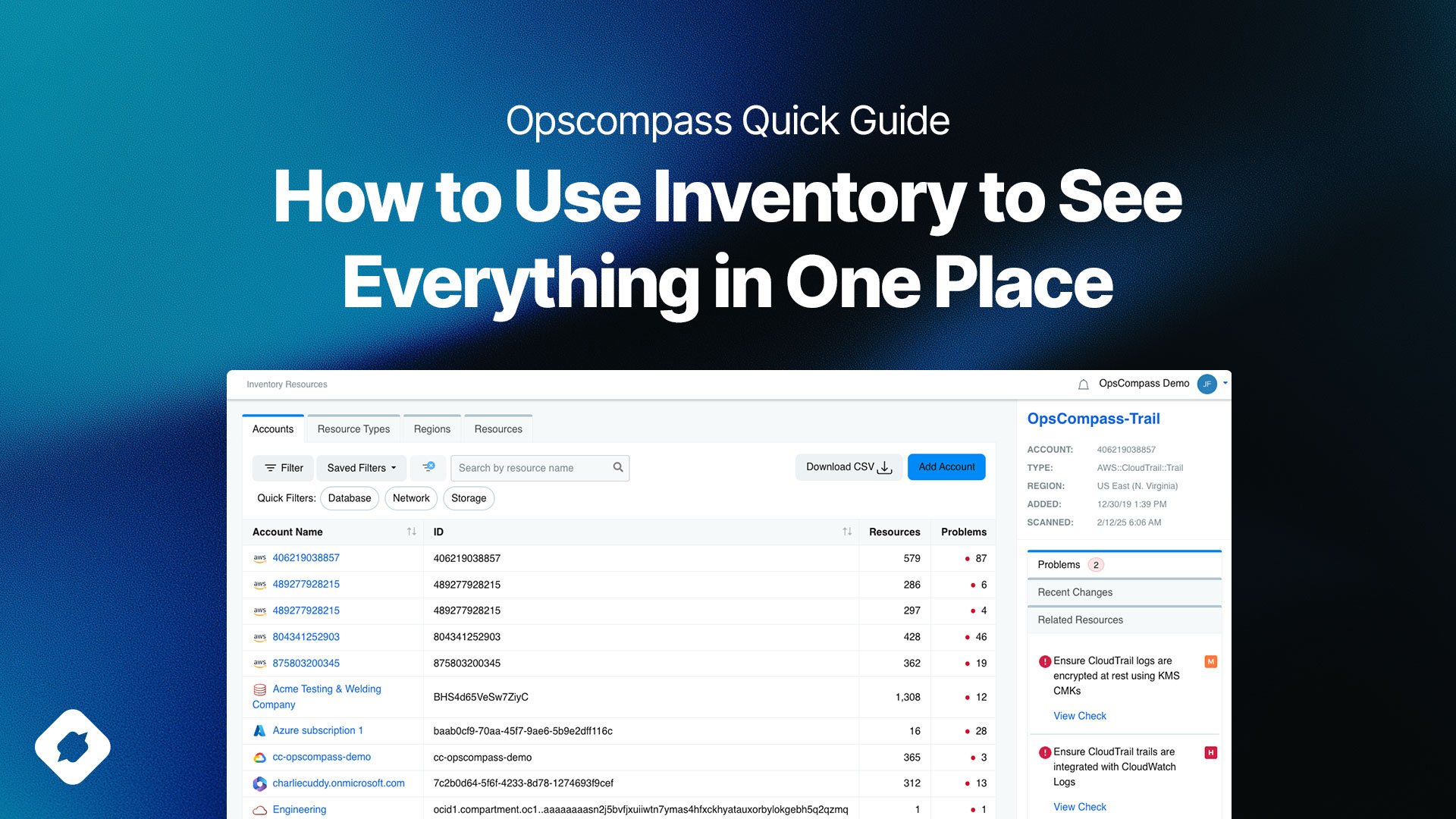

Now’s the time to start a regular cadence of snapshots of your cloud to keep track of inventory and know when configuration changes occur. You need visibility from a single pane of glass into multiple clouds under your roof with the ability to sort by providers, accounts, resource types and regions.

The right level of visibility can create a healthy cloud environment for new business models that take advantage of disruption whether it’s spikes in web traffic or new forms of online trading and transactions.

Point-in-time visibility into your cloud infrastructure can help you know if you’re complying with internal baselines and specific regulatory benchmarks. Visibility tools can make life easier for dedicated IT compliance experts by automatically benchmarking every change against compliance standards. This includes the ability to adapt to market changes that impact your security posture.

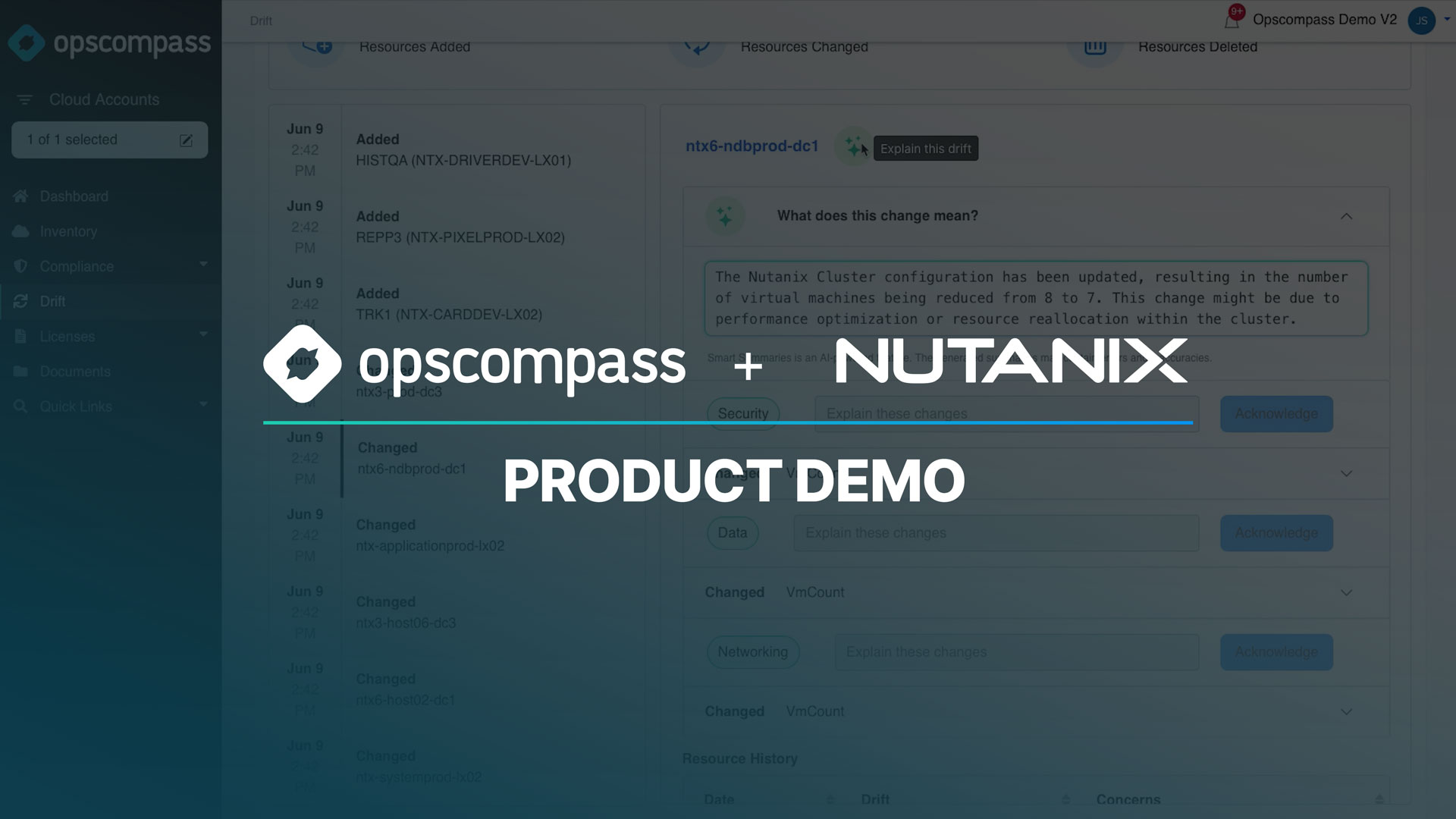

A clearer view into your cloud can help you identify and respond to configuration drifts as your organization adapts IT to take advantage of new opportunities. In the process, you can keep a lid on costs and avoid potential vulnerabilities.

As you look at your cloud for the months ahead and evaluate new opportunities, make sure you have the visibility needed to respond to audits without taking critical resources from your team of cloud architects.

As your IT teams begin to return to the office, make sure they have the visibility and insights to keep your multi-cloud environment safe and operational. Do they know how to spot potential vulnerabilities? And do they have the right access permissions to keep your cloud safe?

Now is the time to conduct a comprehensive review and inventory of your cloud environment to determine if the resources are there for the year ahead. This includes evaluating the estimated costs of supporting future events and ensuring your security posture is solid and ready to meet your regulatory standards.

OpsCompass can help you keep track of your total cloud landscape and resources. We’ll help you learn what causes future configuration drifts and pinpoint resource needs based on your consumption models.

With a healthy cloud environment, your banking or insurance cloud environment will be flexible and resilient to take advantage of next year’s surprises and opportunities.