How to equip your banking or insurance cloud to support mobile computing

These days, the app is king. What grew from a mobile extension of online shopping has now become the preferred means of doing almost everything, especially when it comes to banking and insurance.

Even before the pandemic socially distanced everything and everyone, more than 75 percent of us were using our phones to check our account balances and conduct basic transactions. By 2021, according to the data firm Statista, the world will include more than 7 billion people actively using their phones in place of in-person interactions.

Where banks once applied budgets and energies to improving the retail branch experience, they now focus on allowing customers to access services from anywhere, 24-hours a day. It’s all about making it easier to use mobile devices to scan and deposit checks, transfer funds, or file and check on claims for home and auto incidents. To make it even more complicated, there’s a growing market of payment methods such as Venmo and PayPal.

So, what does this mean for your cloud?

In addition to speed and convenience, mobile banking and insurance services are placing excessive demands on cloud resources. Banks and insurance agencies face new spikes in volume, unauthorized access, multiple device authorizations, and new pathways for hackers to access their infrastructure. Given these disruptions, you could find yourself quickly out of compliance with critical regulations, under-or over-provisioned, and drifting from your approved configurations.

Visibility and control are essential to maintaining a healthy and secure cloud. But chances are you’re operating with an obstructed view of a landscape with many clouds.

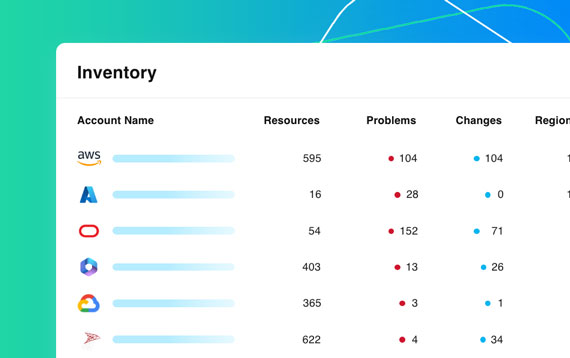

With a comprehensive view from a single pane of glass, you can embrace new technologies by sorting and managing tasks by providers, accounts, resource types, and regions, and responding more efficiently to spikes in web traffic and volumes of market customer data.

In addition to a better view and resource management, you need to stay on top of potential factors that can cause you to fall out of compliance with industry and organizational guidelines. Online services and remote offices have the potential to creep into your cloud and alter your compliance score.

Integrated management, configuration, and automation tools can create more opportunities for misconfiguration and exploitation. Unless managed properly, these risks and vulnerabilities can bring your IT infrastructure to a standstill and tarnish your reputation and customer relationships.

Audits can also cannibalize critical resources to track down information. Few organizations have the excess talent pool for that. With visibility into your cloud at any point in time, you know if your compliance levels meet internal baselines and specific regulatory benchmarks. And you can record details for future audits without sending your team on a wild goose chase.

A comprehensive view ensures you have the resources you need to respond to future app-driven demands and stay within budget. OpsCompass can help you be proactive about managing your cloud spending, attributing costs to business units, and issuing alerts when they hit your defined budget thresholds.

To find out how you can adapt your multi-cloud environment to meet app-based banking and insurance demands, check out our whitepaper.